Lite Paper

Operation and economic model of the MID token issued on the Elrond blockchain

Disclaimer

This document outlines the steps and uses of the MID token that we want to implement.

Some values presented in this document could evolve to meet the needs of our users or to ensure the conservation of the usefulness and value of the token.

It therefore presents conceptual information that is the subject of continuous study from a legal, fiscal and economic point of view.

Report

EGLD staking requires a minimum of 1 EGLD and is more expensive for a small holder to compound their interests over time. In addition, at the high point on November 23, 2021, the value of an EGLD rose to $544.25 making participation in staking even more difficult to access.

Goals

The MID is a service token in ESDT format circulating on the Elrond blockchain. Its primary objective is to allow participation in staking without the need to hold the required minimum amount of 1 EGLD. The MID will have a "theoretical" value based on EGLD collateral held by Middle Staking and a "market" value based on fluctuations in its liquidity on decentralized exchanges (Maiar Exchange, Jexchange). We will extend the uses of the MID token over time with, for example, access to an E-learning platform or on-chain services through partnerships.

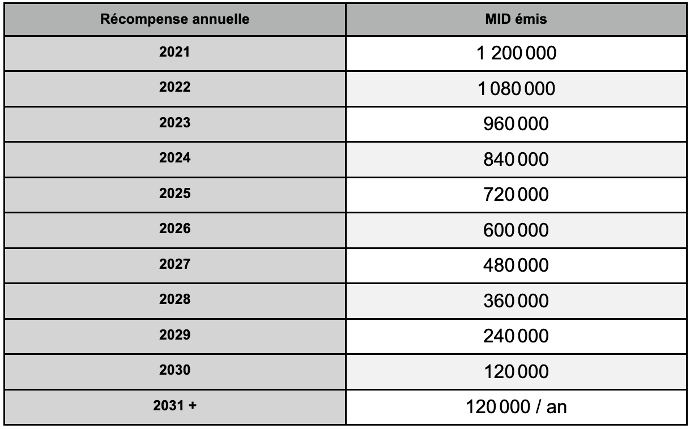

Annual Staking Distribution

Each year participants in the EGLD staking contract will be awarded MIDs up to their participation in the generation of rewards.

The distribution of MIDs is calculated on the sum of the rewards claimed by native staking participants in EGLD through the "Claim" and "Redelegate" functions over the year.

This way, we can reward regular users who participate in native EGLD staking.

Only the rewards generated by the contract are taken into account in the calculation.

List of operations

Distribution to 2021 Participants

Middle Staking deposited in January 2022 120 EGLD in a staking contract.

In return, 1,200,000 MIDs will be distributed to addresses that generated rewards in 2021.

The amount distributed in MID to users is proportional to the amount of cumulative rewards over 2021 taking into account all "Claim" and "Redelegate" type transactions.

An account that has generated more rewards will therefore receive more MIDs than an account that has generated practically nothing.

Staking rewards generated in 2021 but claimed in 2022 will carry over to the following year's distribution.

Listing on Jexchange

Listing on jexchange.io will allow users to securely trade MID without providing liquidity.

Listing on jungledex.com is considered to make the MID more liquid with little intake

Preservation of value

The collateral in EGLD makes it possible to guarantee the value of the MID over time.

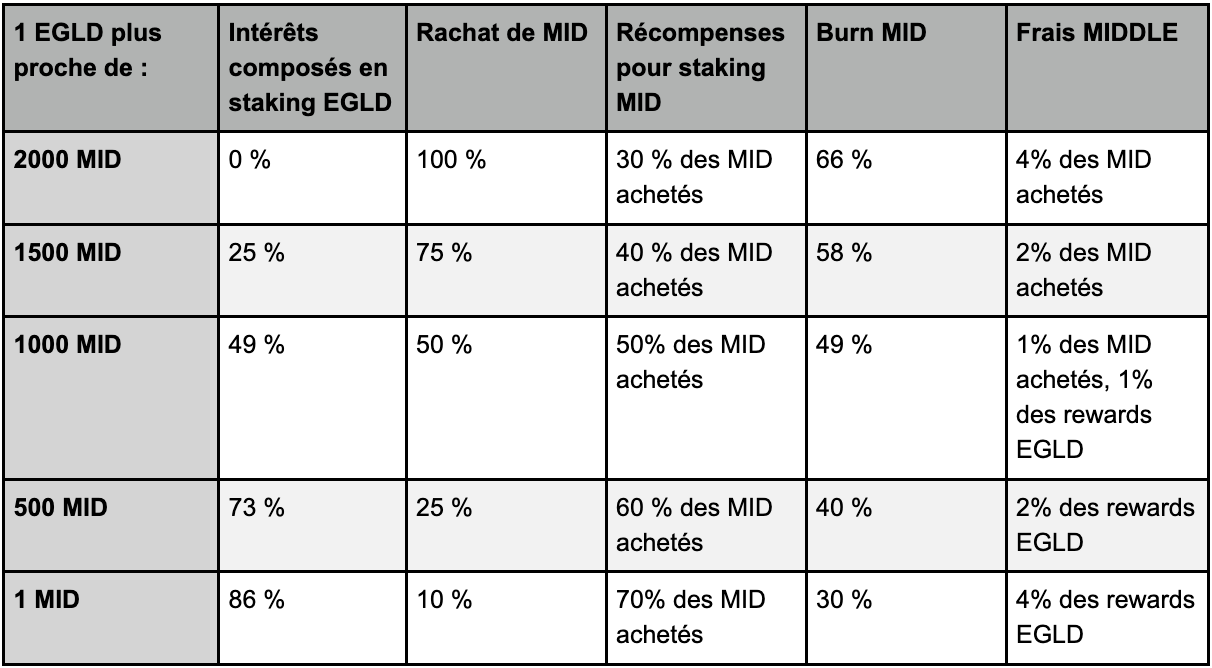

This collateral will generate staking rewards which will be used as follows:

If 1 000 MID > 1 EGLD :

Staking rewards will mostly be compounded in the staking contract(s).

If 1 000 MID < 1 EGLD :

Staking rewards will be mostly used to redeem and burn MIDs

Possible application example for using staking rewards

These values given by way of example may be adjusted over time in order to improve the service.

MIDs purchased on the exchange (excluding Middle Staking management fees and rewards for MID staking) are destroyed, allowing their values to be restored over time against the EGLD.

In the case of a sharp fall in the value of the MID against the EGLD, the redemption and destruction will be more fast.

In the case of a sharp increase in the value of the MID against the EGLD, the rate of destruction decreases but the collateral in EGLD increases more quickly.

"Staking Rewards" MIDs will be distributed through a dedicated MID staking contract.

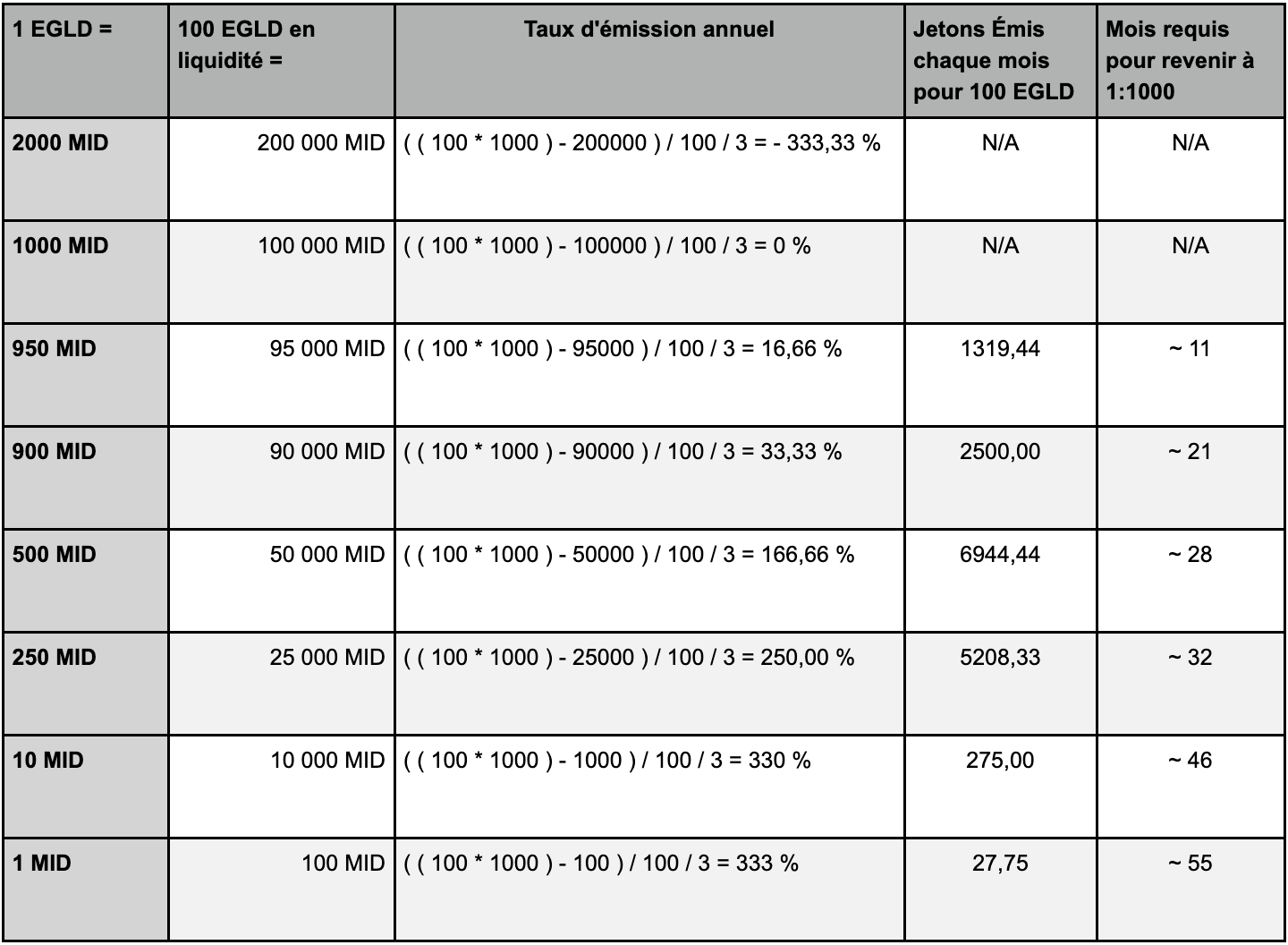

Growth

In the event that the MID sees its value increase against the EGLD, new MIDs will be put into circulation.

The number of tokens issued will take into account the number of EGLDs (or their equivalent in USDC) and MIDs in liquidity.

70% of the tokens issued will be used to buy back EGLD to increase the collateral.

30% will be added to MID:MID staking rewards.

These rates may vary with the establishment of a vote.

The basis for calculating inflation only takes into account the liquidity present on the exchange and not all of the tokens in circulation. With little liquidity, inflation will therefore be slower to avoid a significant variation in the price.

Sample application for 100 EGLD in cash

Calculated once a month before issue using a 30-day average.

( (NB EGLD * 1000) - NB MID ) / 100 / 3 = annual rate

NB MID * annual rate / 12 = tokens issued monthly

Staking and vote

In an effort to add utility to the MID, we are aiming to implement a staking program where users will be able to deposit their MIDs into a contract that will allow them to choose the distribution of staking rewards in EGLD and to receive MIDs or other tokens.

The choices we are considering:

% dedicated to charitable funds

% dedicated to internal development

% dedicated to marketing

% dedicated to increasing collateral

% dedicated to MID staking rewards (and therefore voters)

% dedicated to annual native staking rewards in MID

% dedicated to destruction

% dedicated to new uses

Service creation

Give utility to the token by giving it exclusive benefits. (e-learning, training, merchandising/NFT, access to services, purchase/sale of assets, WL partners, etc.)

Decorrelation and stabilization.

As EGLD is a highly volatile asset, we plan to add other values such as stable tokens, fiduciary currencies or partner tokens to the collateral depending on the development of the network and market opportunities.

Use(s) of collateral

Staking :

EGLDs added to collateral are placed in staking contracts to generate EGLD rewards.

DeFi :

A portion of the staking rewards may be used to take a position in certain liquidity reserves to allow diversification of the collateral.

Token Information

Properties

Ticker : MID-ecb7bf

Name: MiddleStaking

URL : https://explorer.elrond.com/tokens/MID-ecb7bf

Decimals : 18

Attributess :

Can Upgrade, Can Mint, Can Burn, Can Change Owner, Can Pause, Can Freeze, Can Wipe

Collateral address: erd1c3nfhvj5jgulw62yndr6fgh0fcmut34fful733tl998zpt9s2k5qrxumhs